Burned by PayPal

PayPal stands accused of ‘burning’ web conferences and negatively impacting the web industry. We talk to those affected and ask how the payment provider could improve its service

Sign up to Creative Bloq's daily newsletter, which brings you the latest news and inspiration from the worlds of art, design and technology.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

This article first appeared in issue 226 of .net magazine – the world's best-selling magazine for web designers and developers.

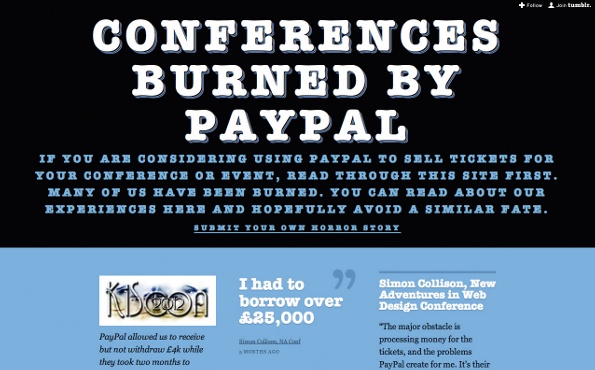

“Using PayPal to receive funds for your business seems to be a game of Russian roulette,” argues UX designer Aral Balkan. He’s one of an increasing number of web conference organisers who claim to have been ‘burned’ by the payment giant.

The main sticking point seems to be the way the payment company can lock accounts for significant periods of time, freezing a business’s funds – often when it most needs them.

This can cause big problems for organisers of web conferences. In Balkan’s case, a month before his Brighton event, Update 2011, a three-month freeze was placed on the conference’s accounts. “What business can survive without cash flow for three months?” he protests.

Balkan is not alone. Last year, New Adventures in Web Design was nearly derailed in similar circumstances. Aware that suspensions had hit other conferences, its founder Simon Collison says he “begged PayPal to not suspend my account while hundreds of people were signing up”. Tickets went on sale and sales rolled in. But a few weeks later, a 100 per cent reserve was applied, and PayPal demanded what Collison describes as “all manner of unnecessary paperwork”, only agreeing to release money later “in chunks around the event, but mostly after the conference, which is useless”. The event was saved through a £25,000 loan from a generous individual, without which, Collison claims: “NACONF would have been cancelled. Business ruined. Me bankrupt.”

Sadly, digital consultant Kevinjohn Gallagher wasn’t so lucky: “Open Source Scotland 2012 early-bird tickets sold out in 90 minutes,” he recalls. “I was over the moon – until I found my PayPal accounts suspended.” Immediately, the conference had to be restructured, but a triple-whammy of Edinburgh University payment terms adjustments, “the WordPress community throwing its toys out of the pram” and PayPal “stonewalling” Gallagher regarding when ticket sales income would be released led to the event’s cancellation. Gallagher is now trying to personally cover costs, and his accountant has advised him to sell his house.

Speedy sales

Some might argue that PayPal is merely protecting purchasers, especially with nascent conferences, but the experiences of developer Remy Sharp suggest otherwise. In the first two years of his JavaScript conference Full Frontal he had no problems; it was only in the third that PayPal locked his account without warning.

The issue seems to have been the speed of sales. In years one, two and three, the conference sold out in six months, three months and four days, respectively. It seemed to Sharp he was being punished for being too successful: “We put through too much money, because our conference had become popular after years of hard work!”

It wasn’t a matter of not doing his homework, he adds. Before signing up, Sharp sent PayPal “reams of documentation proving the existence and legitimacy of the business. Had I then been told a spike in revenue would mean locking down money, or that PayPal would hold our money until three months after the event, I could have made a reasonable decision regarding whether to use it.”

Some savvy forward-thinking (each event was funded with income from the previous year) ensured Full Frontal survived. But Sharp remains bitter, claiming that PayPal’s procedures are “poisoning independent conferences, single-handedly shutting them down”.

dConstruct curator Andy Budd has also experienced locked accounts owing to rapid sales and funds being held for months after an event. He points to the flawed logic behind the latter – “The rationale is to manage ‘returns’, but you obviously can’t ‘return’ a conference you’ve already attended!” he points out.

Like Sharp, Budd complains about being “forced to give PayPal financial information and personal ID” beyond anything demanded by banks. “This would be okay if there was a friendly accounts person to help. But like most big online organisations, PayPal goes out of its way to automate the processes and stop you speaking to people with authority to assist.”

Opposing view

Clearly PayPal is a hugely successful company for a reason: it provides an excellent service to the vast majority of its customers in the vast majority of situations. Indeed, when we trailed this article to our Twitter followers, a number of them reacted sharply with messages of support for the company and positive accounts of their dealings with it. But while PayPal’s operations may work well in general, there is a case to answer in terms of the specific complaints detailed here. However, when we asked PayPal for comment, its spokesperson would only refer to a statement it previously sent us when we first covered the issue in our news section back in issue 221 and said it had nothing to add.

The statement reads: “PayPal works hard to ensure it strikes a balance between protecting both ticket buyers and event organisers. Often tickets for events are sold months in advance and there are many reasons why an event could not take place and buyers want a refund.”

It continues: “[PayPal works] closely with organisers on an individual basis to ensure that wherever possible funds are released in order to fund an event before it happens and also that there are sufficient funds to refund ticket buyers should anything go wrong so that both buyers and sellers can be confident when using PayPal.”

Sign up to Creative Bloq's daily newsletter, which brings you the latest news and inspiration from the worlds of art, design and technology.

Need for regulation

PayPal clearly believes it’s doing a good job, but the conference organisers we spoke to suggest otherwise. “If PayPal wants to lock business money away to protect from chargebacks and cancellations, which is how banks work, it should be regulated like a bank,” argues Sharp. Gallagher suggests “increasing honesty and transparency – not just with the web industry, but also its customers”.

Creative coder Seb Lee-Delisle agrees, recalling how attempted sales for a recent CreativeJS workshop were being abandoned: “Buyers’ cards were declined by PayPal, which provided an unhelpful error message: ‘The credit card you entered cannot be used for this payment. Please enter a different credit or debit card number.’ Buyers assumed something was wrong with their cards, and I would have lost business had I not followed up.”

In fact, the cards were fine, but PayPal was rejecting ad-hoc payments from anyone without an account. A friend of Lee-Delisle’s was told this “sometimes happens to people trying to make a payment without an account”. He guesses PayPal considers large ad-hoc payments high-risk and therefore ‘encourages’ people to set up a PayPal account. “But this lack of transparency isn’t helpful,” Lee-Delisle complains. “If there are conditions where PayPal won’t accept ad-hoc payments, clarify them – don’t make customers think there’s something wrong with their card!”

Budd agrees: “Things aren’t easy for PayPal, which must create a system that works for a wide range of users while maintaining security,” he concedes. “But it should look at pain points for customers and address them directly. If many conferences have similar problems, PayPal could create an account type for conference organisers, with different thresholds and triggers.”

And Collison suggests the company revisits how it communicates with customers: “Tell us clearly what the rules and restrictions are,” he urges. “Put humans on the end of phones and allow us to have conversations about our accounts and concerns. This wouldn’t solve everything, but it’d go a long way towards a better working relationship.”

The Creative Bloq team is made up of a group of art and design enthusiasts, and has changed and evolved since Creative Bloq began back in 2012. The current website team consists of eight full-time members of staff: Editor Georgia Coggan, Deputy Editor Rosie Hilder, Ecommerce Editor Beren Neale, Senior News Editor Daniel Piper, Editor, Digital Art and 3D Ian Dean, Tech Reviews Editor Erlingur Einarsson, Ecommerce Writer Beth Nicholls and Staff Writer Natalie Fear, as well as a roster of freelancers from around the world. The ImagineFX magazine team also pitch in, ensuring that content from leading digital art publication ImagineFX is represented on Creative Bloq.